I experience much discomfort at the oft-heard contention—by no means a new one—that tuition increases faster than inflation and faster than the growth of family incomes. A common conclusion from these paired facts—and they are facts—is that this cannot be sustainable. What are we to make of this?

The primary economic force to be accounted for in private independent school pricing is known as “Baumol’s Cost Disease.” William Baumol, writing in 1967, advanced the hypothesis that economic sectors with low or no productivity growth, such as schools, must increase wages (and, thus, tuition levels) at rates higher than increases in consumer prices (represented by the Consumer Price Index). Simply put, schools are labor intensive enterprises – NCS’ labor costs are 77% of the budget. Schools, however, cannot easily increase efficiency in what they produce.

A school doesn’t “produce” anything like computers that can be re-priced based on more efficient production or research breakthroughs. I can get more computing power for less money today than I could ten years ago. That research/manufacturing model doesn’t transfer to schools at all.

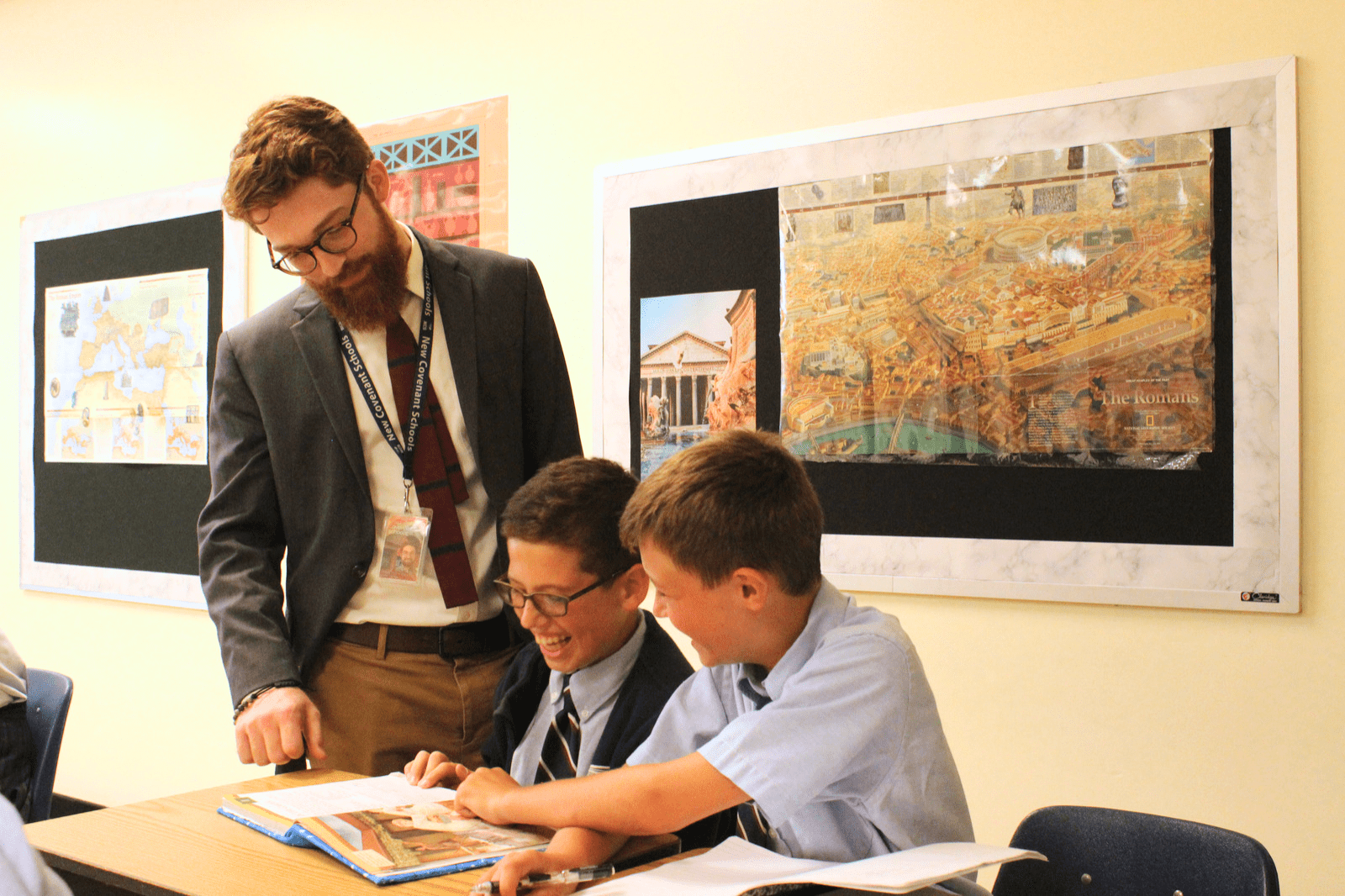

Thus, one way to hold down tuition is to increase class size. More students per class equals more revenue, and thus the average cost goes down for everyone. The problem is that neither teachers nor parents want larger classes. Some schools choose this “easy” option, but eventually they reap the bitter fruit of this path. Another way, of course is to hire cheaper, less qualified instructors. The folly of this path should be self evident.

In order to maintain the quality school that attracted you at first, we know that we must meet an inflation gradient between 1.6-2% in non-payroll line items. That’s utilities, maintenance, paper, copiers, etc., all before we address salaries and benefits. Since labor is such a large part of our budget, you have to add about 1.5% each year to maintain staff fairly. That puts our budget immediately into the 3%+ range. Our consultants who study this matter very carefully, advocate 5%!

I tested our numbers against those of the Independent School Management group. I looked back over several years of increases of 2.5%, 3%, even flat! Then, whammo, 6.6% and 4.5%. Guess what? I have found that our average increases over five years are running just under 5%.

Yes, tuitions have increased faster than inflation. Yes, tuitions have also increased faster than families’ income growth. These are facts that are layered intractably into the fabric of labor-intensive organizations. William Baumol is correct. Embracing these facts and by creating a multiyear plan is the best way for us to help you in your financial planning.